http://www.mdpi.com/2079-9276/3/1/31

Abstract:

Stormwater runoff from urban areas is a significant source of water pollution in the United States. Many states are promoting low impact development (LID) practices, which provide a variety of direct and ancillary ecosystem services. We describe a meta-analysis designed to evaluate the property value benefits of LID practices that reduce impervious surfaces and increase vegetated areas in developments, and present an example application to a hypothetical land use scenario. From the many hedonic property valuation studies of the benefits of general open space, we identified 35 studies that valued open spaces that were similar in nature to the small, dispersed open spaces characteristic of LID. The meta-regression estimates the percent change in a home’s value for an observed percent change in open space within a specific radius of a parcel, based on changes expected to result from LID approaches that increase green spaces. Our results indicate that the design and characteristics of a project affect the magnitude of benefits, and that values decline with distance. More broadly, the meta-analysis shows percent change and proximity are robust determinants of household willingness to pay for aesthetic and other services associated with local availability of small, dispersed open spaces resulting from LID, but that values for other features, including type of vegetation and recreational use may be site-specific. Policymakers and developers could draw on our synthesis of site characteristics’ effects to maximize benefits from open space associated with LID....

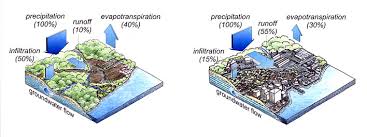

Besides loss of natural resource areas, habitat corridors, and buffers to wetlands and stream, conventional development (right hand graphic) creates large areas of impervious surfaces which prevent the infiltration of rainwater. Under natural (pre-development) conditions (left hand graphic), rain infiltrates through soils and percolates downward to the underlying water table, where it recharges the groundwater. Throughout the more permeable areas of Massachusetts approximately 50% of the annual precipitation infiltrates and recharges. Groundwater serves as drinking water supply and provides base flow to streams and wetlands. This base flow is critical to habitat quality for fish and other aquatic ecosystems. In many areas of eastern Massachusetts, where watersheds have become significantly urbanized with extensive impervious areas, the base flows of streams have been diminished. In some cases, such as the Ipswich River where the stream goes dry, eliminating habitat value. Surface runoff is also increased in urbanized watersheds creating greater peak flows which can cause flooding and channel erosion.- http://www.mass.gov/envir/smart_growth_toolkit/pages/mod-lid.html

From the many hedonic property valuation studies of the benefits of general open space, we identified 35 studies that value open spaces similar in nature to the small, dispersed open space characteristic of many LID practices. We estimate a meta-regression model (MRM) of the percent change in a home’s value for a given percent change in open space area within a specified radius of the parcel. Additionally, because our model is intended to be used for benefit transfer, following Boyle et al. [30], we examine various factors that indicate whether the estimates are robust or fragile....We reviewed over 180 studies, including nine stated preference studies, and over 100 hedonic studies of property value changes from improved amenities associated with, or similar to those achieved from LID practices.... The 35 studies provided 119 observations.... Studies examined variation in sales price based on variation in proximity to, adjacency to, or the surrounding amount of open space.... Differences include the specific type, size and features of open space valued, size of the surrounding area considered or distance to open space, population density of the study area, and geographic region.... We simply modeled an impervious cover reduction scenario that produced a 30% increase in vegetated open space (compared to conventional approaches) in most new developments.... The current home value in the ... watersheds with predicted new and re-development was $151,875, translating to an average annual rental value (at a 3% discount rate) of $4,556.... We calculated the total change in annualized property values by estimating the percentage change in rental-equivalent housing values in each buffer zone around each development project in each ... watershed and year, and then multiplying the predicted percent change in housing rental values by aggregate housing rental values.... The MRM is structured so that the marginal effect on property values of an increase in open space depends on the size of the change in open space and the distance from the open space. Based on the aggregate predictions of changes in housing values for each ... watershed and year, we then calculated the sum of the total present discounted value of the change in rental values in each HUC-12. This sum represents the projected benefits of using LID in that HUC-12, over the period of analysis (21 years). In this calculation, all future benefits were discounted back to 2013 dollars using a 3 percent discount rate and then annualized over 21 years.

...

Perceived mean increases in open space range from 1.3% to 3.7% per home across the 250 m and 250–500 m buffers. The use of LID without recreational amenities is expected to result in an annual increase of $30 and $10 in per-property mean rental value for houses in the 250 m and 250–500 m buffers, respectively. As expected, including recreational amenities in LID further enhances property values in the vicinity of the development project. For example, in the 250 m buffer, the expected increase in property values is 13% higher compared to the “no recreational amenity case” (i.e., $34 vs. $30). Although the mean per-watershed increase in property values is relatively modest, ranging from $3.9 to $10.5 thousand per year with and without recreation in the 250 m buffer (from $2.0 to $5.9 thousand per year in the 250–500 m buffer) the aggregate annualized benefits for the state of Illinois can be substantial and range from $31.0 to $36.0 million, without and with recreational benefits. We note that the estimated increase in property values represents a subset of environmental benefits associated with LID.

...

by Marisa J. Mazzotta 1,*, Elena Besedin 2 and Ann E. Speers 2

1 Atlantic Ecology Division, U.S. EPA Office of Research and Development, 27 Tarzwell Drive, Narragansett, RI 02882, USA; mazzotta.marisa@epa.gov; Tel.: +1-401-782-3026; Fax: +1-401-782-3030.

2 Abt Associates Inc., 55 Wheeler Street, Cambridge, MA 02138, USA; E-Mails: elena_besedin@abtassoc.com (E.B.); ann_speers@abtassoc.com (A.E.S.)

Resources

www.mdpi.com/journal/resources

Volume 3; 2014; Pages 31-61; doi:10.3390/resources3010031

Received: 28 October 2013; in revised form: 24 December 2013 / Accepted: 7 January 2014 / Published: 21 January 2014