Independent analysis of Dominion Energy’s Integrated Resource Plan shows opportunity for ratepayer savings with addition of solar and energy efficiency resources, reducing energy imports

On September 24, 2018 Virginia Advanced Energy Economy (Virginia AEE) testified that Virginia Electric and Power Company's (Dominion Energy's) long-term energy resource plan misses key opportunities to reduce ratepayer costs and out-of-state energy imports to the Commonwealth by investing in renewables and energy efficiency.

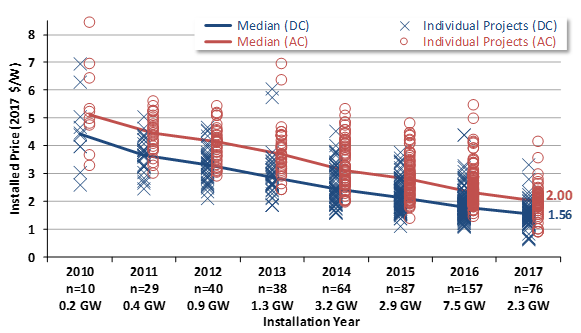

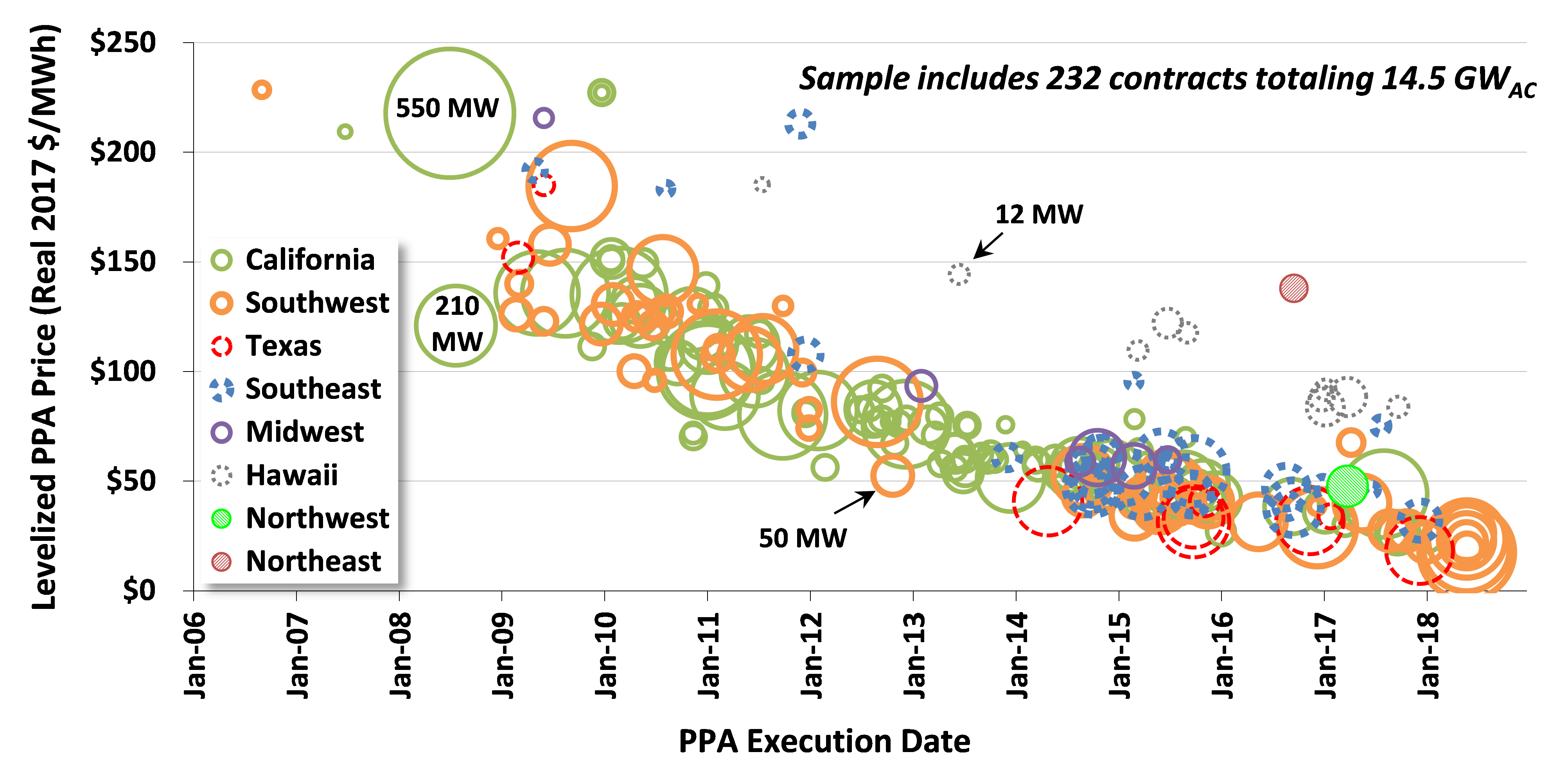

In his testimony before the State Corporation Commission (SCC), Virginia AEE Executive Director Harry Godfrey shared highlights of independent analysis using assumptions and forecasts from the utility’s submitted 2018 Integrated Resource Plan (IRP). He reported that, by allowing for more low-cost solar and energy efficiency resources, Dominion’s electricity system costs would drop between $700M and $1.7B, providing cost savings for residential and business customers. Also, advanced energy options had the added benefits of reducing energy imports and supporting a framework for participation in future carbon reduction programs. Godfrey’s testimony drew from formal comments* submitted to the SCC on Dominion’s IRP.

“Our analysis definitively shows that Dominion has limited its opportunities to save ratepayers money by not allowing for the development of more least-cost resources like solar energy and energy efficiency,” said Harry Godfrey, Executive Director of Virginia Advanced Energy Economy (Virginia AEE). “By lifting the utility’s overly restrictive limits on renewables and energy efficiency, we can reduce costs by up to $1.7 billion for residents and businesses and reduce energy imports from out of state.”

For its analysis, Virginia AEE hired 5 Lakes Energy, an expert consulting firm focused on economic and energy policy. 5 Lakes’ employed the State Tool for Electricity Planning (STEP), a least-cost resource-planning tool specifically tailored to Virginia, to analyze five possible policy scenarios that Dominion used in its IRP. 5 Lakes consultants employed the same set of assumptions employed by Dominion, as well as the utility’s projections regarding future load growth, fuel prices, and emission allowances.

“Our analysis presents a no-regrets option for all Virginians, whereby we can save ratepayers up to $1.7 billion over the next 15 years while producing secure, clean, affordable energy,” said Godfrey. “By sourcing more energy resources in the Commonwealth, we gain the associated economic impact, including sustaining and growing the nearly 100,000 advanced energy jobs here in the Commonwealth.”

In August, Virginia AEE released a fact sheet showing that Virginia has 97,700 people working in advanced energy across the state, and are expected to increase by 5% this year. This represents more than those employed by groceries and supermarkets (75,133), and twice as many as those at hotels, motels, and resorts (45,777) across the state. Virginia advanced energy jobs were led by those in energy efficiency and energy generation resources such as solar, nuclear and wind. The U.S. has a total of 3.4 million working in advanced energy jobs across the nation.

Virginia AEE members have identified five policy priorities that could further accelerate this growth and positive economic impact:

- Improving Energy Productivity

- Expanding Market Access

- Driving Transportation Electrification

- Accelerating Renewable Energy Deployment

- Building a 21st Century Energy System

Godfrey’s testimony came at the start of two days of hearings on Dominion’s 2018 IRP before the State Corporation Commission. The Commission is expected to deliberate on the matter and issue a final ruling in the months ahead.

solar facility ("farm") built by Community Energy Solar in Accomack County

Source: VA Dep't of Mines, Minerals, and Energy, Energy in the New Virginia Economy: Update to the 2014 Virginia Energy Plan

Virginia, Advanced Energy Economy (AEE) https://www.aee.net, a group of businesses that are making the energy we use secure, clean, and affordable which seeks to drive the development of advanced energy to boost the state’s economy and competitiveness by working to remove policy barriers, identify market growth opportunities, encourage market-based policies, establish public and private partnerships, and serve as the voice for companies innovating in the advanced energy sector.

Press Release dated September 24, 2018